Validating credit card numbers isn’t just about identifying the issuing bank or card type; it’s also about verifying if the number itself is structured correctly. One of the most widely used methods for this kind of validation is the Luhn Algorithm. MR Checker incorporates this powerful algorithm into its system to offer users accurate and secure results.

Whether you’re testing payment systems or verifying a customer’s card details, knowing if a number passes the Luhn check is essential. MR Checker provides instant results by using this algorithm, alongside other database-driven checks, to confirm whether a card number is potentially valid before moving forward with further use.

What Is the Luhn Algorithm?

A Mathematical Formula for Validity

The Luhn Algorithm, also known as the Modulus 10 or mod 10 algorithm, is a simple checksum formula used to validate identification numbers. It was created by IBM scientist Hans Peter Luhn and is widely adopted for credit card validation today. This algorithm detects most accidental errors in card numbers, such as a mistyped digit.

The process includes reversing the card number, doubling every second digit, and subtracting 9 from numbers over 9. The resulting numbers are then summed. If the total is divisible by 10, the card number passes the Luhn check.

Why It’s Important for Validation

This algorithm doesn’t guarantee that a card is active or linked to an account—it only ensures that the structure of the number follows industry rules. It helps weed out fake or mistyped numbers quickly. That’s why tools like MR Checker rely on the Luhn Algorithm to perform an essential first step in card validation.

Without Luhn validation, systems could waste time on clearly invalid numbers, leading to inefficiencies and potential security issues.

Used by All Major Card Issuers

The Luhn Algorithm is used across all major card networks: Visa, MasterCard, Amex, Discover, and more. Its universality makes it the most logical method to include in any credit card checking tool. MR Checker supports a wide range of card types and utilizes Luhn checks on each input.

By applying a standard verification model, MR Checker ensures accuracy and consistency, regardless of which card type is entered.

MR Checker Applies the Luhn Algorithm

Immediate Structural Verification

As soon as a user inputs a card number, MR Checker runs the Luhn Algorithm before proceeding with any BIN detail lookup or card type detection. This helps identify whether the number is formatted correctly before revealing further card data. If a number fails the Luhn check, MR Checker flags it instantly.

This quick verification saves time and enhances the reliability of subsequent results. Users know immediately whether a card number is even worth checking further.

Combined With BIN and Card Type Checks

MR Checker doesn’t rely on the Luhn Algorithm alone. Once a number passes the Luhn test, the tool performs BIN detail extraction, detects the card brand (like Visa or MasterCard), and identifies the card level and type. But the Luhn test serves as the entry point.

By layering this algorithm with database lookups, MR Checker creates a multi-step validation process that covers both structure and identity.

No Delay in Processing

Despite performing several behind-the-scenes checks, including Luhn validation, MR Checker returns results within seconds. Its efficient system design allows for instant feedback without compromising accuracy.

Speed and reliability together make MR Checker suitable for high-volume use cases where multiple cards need to be validated quickly.

Why Luhn Validation Matters to Users

Prevents Input Errors

Most user-entered card mistakes are due to typing errors. The Luhn Algorithm helps catch these immediately. MR Checker flags these errors so users can correct the number instead of receiving faulty BIN or brand information.

This improves the accuracy of form submissions, payment setups, and card record-keeping.

Supports Payment Testing

For developers working with sandbox environments or fake card numbers, using the Luhn Algorithm ensures that test data is realistic. MR Checker helps confirm if a test card number is structurally sound, avoiding errors during transaction simulation.

When developing or debugging payment systems, this type of validation is critical for maintaining test quality.

Adds a Layer of Fraud Prevention

Although the Luhn Algorithm can’t detect stolen or unauthorized cards, it helps flag numbers that don’t follow the card industry structure. Fraudsters sometimes use completely random numbers; failing the Luhn test immediately identifies them as invalid.

MR Checker’s use of this algorithm helps protect systems from unnecessary processing of invalid numbers.

Key reasons MR Checker uses the Luhn Algorithm:

- Catches formatting and typing mistakes

- Reduces invalid card processing

- Provides instant user feedback

- Supports realistic card testing

- Helps filter out fraud attempts

Benefits of MR Checker’s Luhn Integration

Works on All Major Card Brands

The Luhn Algorithm is compatible with most card issuers around the world. MR Checker applies it across Visa, MasterCard, American Express, Discover, and others. This universal compatibility allows MR Checker to validate cards from almost any country or network.

Whether the card is domestic or international, debit or credit, the Luhn check remains a critical first step.

No Technical Knowledge Required

One of MR Checker’s advantages is that it’s built for all users, including those with no programming or card industry knowledge. You don’t need to understand how the Luhn Algorithm works to benefit from it. Simply enter a card number and get real-time feedback.

This makes it ideal for business owners, support teams, and casual users who want to verify a card number’s structure without dealing with complex systems.

Part of a Larger Validation Suite

Luhn validation is just one component of MR Checker’s multi-level checking system. After confirming the number structure, MR Checker extracts BIN information, detects card type, and presents a full breakdown of the card issuer and classification.

This layered approach ensures that each number is both logically correct and identifiable—key for secure and reliable use.

MR Checker validates each card with:

- Luhn Algorithm structure check

- BIN detail lookup

- Card network and brand detection

- Card level and country identification

How Developers and Businesses Benefit

Faster User Form Processing

Businesses that collect card details can use MR Checker to speed up user entry validation. By filtering out structurally incorrect numbers upfront, fewer failed transactions occur later. This improves user experience and reduces backend support needs.

MR Checker gives instant validation with zero setup, making it a great addition to onboarding or checkout processes.

Enhanced Testing for Payment Systems

Developers building POS systems, online payments, or mobile checkout solutions rely on test card numbers. MR Checker helps verify that these test inputs follow the correct structure via the Luhn Algorithm. This ensures development environments are realistic and error-free.

Even in live systems, developers can double-check inputs before forwarding them to payment gateways.

Real-Time Fraud Detection

Fraud prevention systems benefit from instant Luhn validation. MR Checker helps flag clearly invalid card attempts, allowing fraud filters to act faster. While it doesn’t replace full fraud systems, it’s a key early indicator that something is off.

This is especially useful in high-risk or high-volume transaction environments.

User-Friendly Approach

Designed for Everyday Use

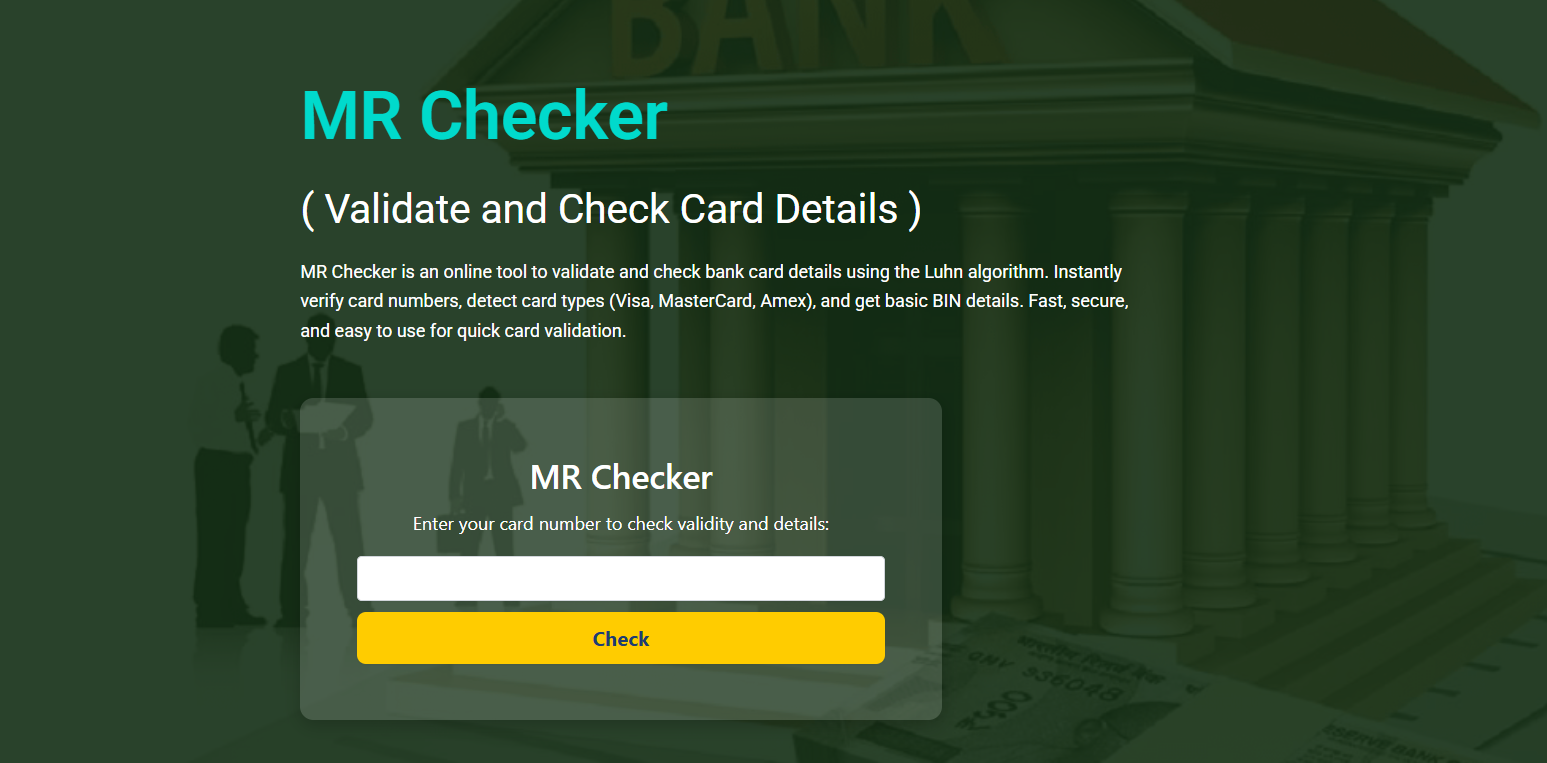

You don’t need to be a security expert or developer to use MR Checker. It’s built to offer advanced features like the Luhn Algorithm in a simple, accessible interface. Users just input a card number and receive structured feedback without needing any technical knowledge.

This user-focused design allows anyone to check card validity in seconds.

No Account Required

MR Checker’s Luhn validation and other features are available without logging in or creating an account. This encourages more users to take advantage of proper card checks and reduces the barrier to entry for fraud prevention and data verification.

Free, fast, and open access is part of what makes MR Checker unique.

Safe and Secure Checking

Even though the Luhn Algorithm doesn’t involve account data, MR Checker processes all checks in a secure environment. Card numbers are not stored or shared, maintaining user privacy. Security-conscious users can validate card numbers without worrying about data misuse.

Secure systems combined with instant results make MR Checker ideal for trust-based verification tasks.

MR Checker offers:

- Secure Luhn validation processing

- No card number storage

- Open access without login

- Reliable results every time

Conclusion

MR Checker uses the Luhn algorithm to ensure reliable and instant credit card validation. Its accurate checks, combined with real-time BIN insights and multi-network support, make it a go-to tool for developers, merchants, and everyday users. With no login required and completely free access, it offers both convenience and trust. Whether for fraud prevention or system testing, MR Checker delivers the speed and accuracy that modern card verification demands.